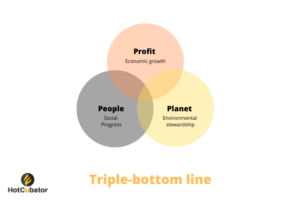

Social Impact investing is becoming more popular as societies and business are trying alternative ways to merge social return with financial return. The idea of social impact investing is exceedingly broad and there are alternative conceptualisations and methods observed in different parts of the world. Many different terminologies such as – Impact investing, socially responsible investing, ethical investing, triple bottom line investing which all have similar connotations. Some of the social impact investment endeavours have a more philanthropic undertones whereas some others have more commercial motivation. In essence, social impact investment refers to – investment made with the intention to bring social and environmental impact alongside financial returns.

The key objectives of social impact investment are to generate output that will have measurable social, economic and environmental improvement. Traditionally, social impact investments are mostly observed in developing societies where social inequality and other problems exist. But social impact investments can be made in both emerging and developed markets too.

The growth of social impact investment in recent years is noteworthy. There are many social impact investment firms operating in the world and successfully contributed to address the burgeoning challenges in sectors such as renewable energy, social inequality, microfinance, healthcare, housing, education and so forth.

Some of the top impact investment firms are – Leapfrog investments, Vital Capital Fund, Triodos Investment Management, The Reinvestment Fund and BlueOrchard Finance S.A.

A research conducted by GIIN (The Global Impact Investment Network) estimated that the current market size of social impact investment is approximately USD 715 billion.

Characteristics of impact investing

The Global Impact Investment Network which is a peak body that monitors impact investment globally has identified the following three core characteristics of social impact investment-

- Positive intention to bring impact in the society.

- A financial return from the investment

- Impact investments target financial returns that range from below market to risk-adjusted market rate, and can be made across asset classes, including but not limited to cash equivalents, fixed income, venture capital, and private equity.

Types of social impact investments –

Here are few different types of social impact investments –

- Social impact bond – A financial instrument that pays a return based on achieving agreed social outcomes.

- Layered investment – Combines different types of capital in non-traditional ways.

- Payment-by-results (PBR) contract – A service provider is paid on the results they achieve. A social benefit bond is a special type of PBR contract.

- Outcomes-focused grant – Non-repayable grant funding provided on the basis of measuring outcomes. May also be used as a guarantee.